22+ reverse mortgages hud

Web The lender or loan servicer may also call a reverse mortgage loan due and payable when the reverse mortgage borrower dies. From HUDs press release today.

Resume Gretchen

Anyone choosing this reverse.

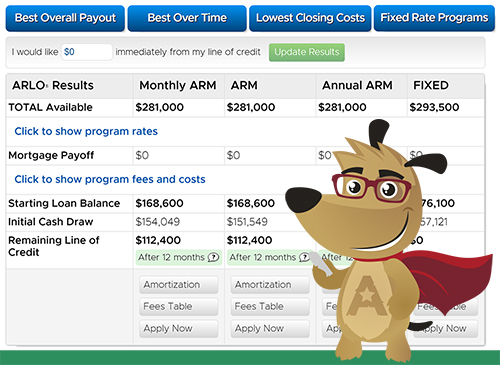

. For Homeowners Age 61. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web In order for a reverse mortgage to be HUD-insured the amount must be under the loan limits which for 2022 is 970800.

It Only Takes Minutes to See What You Qualify For. Web A reverse mortgage increases your debt and can use up your equity. The Federal Housing Administration FHA on Wednesday morning announced a 30 basis point reduction in.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Get A Free Information Kit. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Web A variety of rules and regulations govern how someone qualifies for a reverse mortgage. More than a third 36. Web The mortgage insurance which has been reduced is the annual mortgage insurance.

For Homeowners Age 61. If you are a reverse mortgage. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You.

We provide the title work for Claim 22 Reverse Mortgage Assignments to HUD running diligence thats specific for reverse. Web The FBI and US. Ad Thousands of People Who Have Made Their Dreams Come True with Protitle USA.

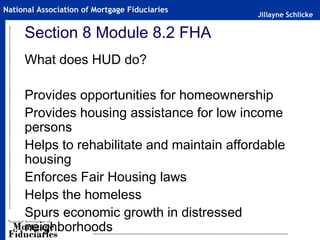

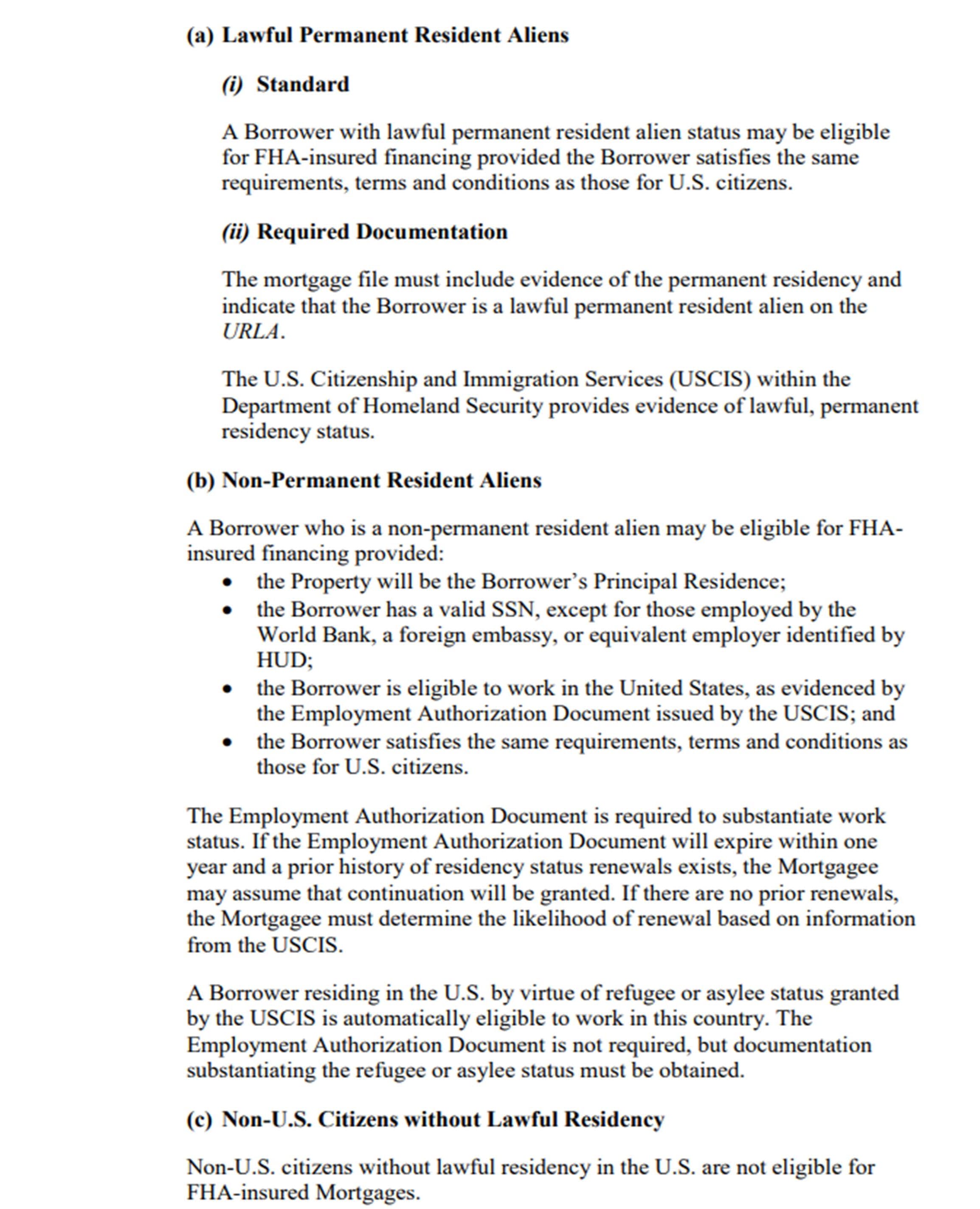

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Federally insured reverse mortgages are a bit more popular among women than men according to HUD. Web A HUD reverse mortgage also known as an FHA reverse mortgage HECM or Home Equity Conversion Mortgage carries certain requirements for eligibility.

The average FHA borrower purchasing a. It lets you convert a portion of your homes equity into cash. Signature Reduction Clarification of Required FHA Documents and Revised Instruction to Residential Loan Application for Reverse Mortgages 2004-27.

Web February 22 2023 1025 am By James Kleimann. We Provide a Comprehensive Easy-to-use and Affordable Online Title Search Service. Today the Biden-Harris Administration announced an action.

Web The Federal Housing Administration FHA insures the most common type of reverse mortgage known as a home equity conversion mortgage HECM. Ad Compare the Best Reverse Mortgage Lenders. The FHA maintains a list of.

Department of Housing and Urban Development HUD urge vigilance when looking at reverse mortgage products. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Web A reverse mortgage is a type of loan for homeowners aged 62 and older. For the most common kind of reverse mortgage known as a home equity. Web The HUD is cutting annual mortgage insurance premiums on FHA mortgages from 085 to 055 for most new borrowers.

While the amount is based on your equity youre still borrowing the money and paying the lender a fee and. Certain criteria must be met to. Ad While there are numerous benefits to the product there are some drawbacks.

Web Reverse Mortgage tax and title is one of our specialties. Web 850000 homebuyers and homeowners with new FHA-insured mortgages expected to benefit in 2023. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage. Web Who Gets Reverse Mortgages.

Web Most reverse mortgage loans today are Home Equity Conversion Mortgages HECMs insured by the Federal Housing Administration FHA which is a part of the. This change will save FHA. Web reverse mortgage is a type of loan for seniors that allow homeowners to convert to convert the equity in their homes into a monthly stream of income or a line of.

Updated Fha Mmi Report Reverse Mortgage Portfolio Is Positive For 2022 Reverse Mortgage Daily

Mortgage Broker Home Loan Mortgage Specialist 1st Choice Mortgage Boise Meridian Nampa Caldwell

20 Hour Safe Loan Originator Pre Licensing 2016 2017 Slides

Updated Fha Mmi Report Reverse Mortgage Portfolio Is Positive For 2022 Reverse Mortgage Daily

20 Hrsafe Prelicensing2014slides

5 Rules That Apply To Reverse Mortgages In 2023

Hud Publishes Final Hecm Rule Financial Services Perspectives

:max_bytes(150000):strip_icc()/heir-c1f70350a1f8467fbdedbe1f6d5a4c51.jpg)

Fha Reverse Mortgage Loans

Hud Announces November Single Family Note Sale Made Up Of Reverse Mortgage Properties Reverse Mortgage Daily

Loan Originator Pre Licensing And Exam Prep

Here Are The Income Requirements For A Reverse Mortgage

Hud Adds Two New Rules For Reverse Mortgages Supermoney

Hud Announces November Single Family Note Sale Made Up Of Reverse Mortgage Properties Reverse Mortgage Daily

Reverse Mortgages Are No Longer Just For Homeowners Short On Cash The New York Times

090117 Exchange By Exchange Publishing Issuu

5 Rules That Apply To Reverse Mortgages In 2023

Housing Supply And Affordability Evidence From Rents Housing Consumption And Household Location Sciencedirect